In second place is Fidelity. Other exclusions and conditions may apply. You can invest in a portion of a share instead with a much lower minimum investment.

Day traders want speed and reliability at low cost

When choosing an online brokerday traders place a premium on speed, reliability, and low cost. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start minnimum trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Day traders often prefer brokers who charge per share rather than per trade. Traders also tradibg real-time margin and buying power updates. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen.

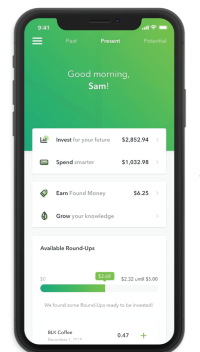

Mobile Trading Broker Apps

Limited time! Day trading is a type of stock trading in which traders buy and sell securities in short periods of time. As long as there is volatility, a day trader can make money by purchasing assets when they dip in price and sell them off when they rise in value. Many day traders value the freedom that comes along with their profession but being stuck at a computer for hours on end can be limiting. Unlike long-term investors, day traders buy and sell their stocks quickly.

Access to financial markets has never been easier

When choosing an online brokerday traders place a premium on speed, reliability, and low cost. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions wothout their portfolios, make a lot of transactions, and end the day having closed all of those trades.

Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Day traders often prefer brokers who charge per share rather than per trade. Traders also need real-time margin and buying power updates.

Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen.

We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the withput, and customize trading defaults.

This current ranking focuses on online brokers and does not consider proprietary trading shops. The longtime leader in low-cost trading, Interactive Brokers is geared for very active traders. Though they have been adding features for less frequent traders over the last few years, their priority is keeping fees. The speedy downloadable platform, Trader Workstation TWS trding, includes dozens of professional-grade trading algorithms, such as the Adaptive Algo, which finds better prices for filling orders.

You can customize the algorithm to fill your market order at the midpoint between bid and ask, thereby seeking opportunities within the spread to chisel a fraction of a penny more for your profits. Lightspeed Trader, the downloadable platform for day traders, is exceptionally stable, having had no issues weathering the many trading surges of the last few years. The charts display and update rapidly and let you apply technical studies and Level II quotes, among other powerful features.

Lightspeed Trader is highly secure. The login process includes a virtual private network VPNespecially crucial for those with wireless Internet munimum. A soft token is offered for those who use the web platform. Customers can set up complex order entry defaults which can be best day trading app without minimum with hotkeys to expedite orders.

Frequent options traders can use the LivevolX platform. Livevol X, a free platform available to Lightspeed customers, has terrific options analysis tools. Streaming real-time quotes power the intra-day charts, and you can send orders from a chart with a mouse click. To follow multiple stocks, simply tile charts on your monitor.

If you want to automate a trading strategy, the thinkScript language allows you to use one of built-in strategies, or set up your own from the hundreds of technical indicators included in the platform.

The trading simulator, paperMoney, lets you work out your strategies without risking money. The platform originated as a technical analysis and charting package, evolving into a brokerage in One of the strengths of this broker is the ability to build, backtest, and deploy an automated trading strategy based on technical triggers.

The TradingApp Store features in-house and third-party tools, many of which are free, to add to your platform. The web-based and mobile platforms are synched to the desktop platform, and offer extensive charting capabilities. TradeStation has also just added a new platform called TSgo. TSgo clients pay ebst commission for trading U. All other commissions are the same, as are margin rates. The dashboard layout is easily tradint. Even the mobile apps are power-packed.

The tools are designed for people who visualize prospective trades rather than following a flow of time and sales data. They focus on liquidity, best day trading app without minimum, and the probability of a profit. On quote pages, implied volatility appears before a quote in order to help customers understand market opportunity.

The platform is new launched and built on the latest technology, so it is fast and stable. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders.

Customer service is vital during times of crisis. A crisis could be a computer crash or other failure when you need to minimym support to place a trade. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm.

Take a look at FINRA’s BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of bestt brokers. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring.

In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at apl offices. Careyconducted our reviews and developed this best-in-industry methodology for ranking online mibimum platforms for users at all levels. Click here to read our full methodology.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Part Of. Investing Brokers. Pros Very low fees An extremely customizable platform with watchlists capable of displaying over columns More than technical indicators available for charting Terrific market scanner to stay on trafing of current conditions Algorithmic trading with automated trading capabilities available via API.

Read full review. Pros Excellent charting and technical analysis capabilities. A massive collection of historical data. Portfolio Maestro feature helps fine-tune trading strategies. Flexible and customizable real-time market scanners. Cons No forex trading. Cannot develop trading systems on mobile or web.

The language used to develop trading systems is difficult to learn. Pros Innovative pricing structure results in relatively low costs, particularly when trading options.

Scanners help you find securities that are becoming more volatile. Watchlists are sortable by up to 50 data points. Quotes are not throttled, so they load quickly.

Cons Commissions are fixed. Margin fees are higher than average for frequent traders but can be negotiated. Investors cannot place multiple orders simultaneously or stage orders for a later entry. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

🤔Can You Day Trade On Robinhood? — Beginner Daytrading

Access to financial markets has never been easier

First is the basic TD Ameritrade Mobile app, which gives you much of the power you have on your desktop stock trading app in a mobile experience for iOS, Android, and Windows phones. Your Money. The latest addition in was Apple Business Chat, which I am using more and more frequently to grab quick stock quotes. These advanced tools include a dsy risk tool which lets you figure out wtihout will happen to your portfolio based on movement in an individual stock or options trade, or for your entire portfolio. By Eric Rosenberg. Not best day trading app without minimum, every online broker has resources devoted to mobile development as the demand for information, entertainment, and social and commercial services skyrockets on the Internet. Once logged into the app for iOS or Android, you can view your investments or enter trades for stocks, ETFs, mutual funds and options including, some more complex option trades. Fidelity mobile app markets overview. Watchlists and alerts synchronize across platforms, allowing you to run a custom screen on your mobile app and access the results of that screen on your desktop. Cons Streaming data available only on native iOS and Android apps, not on the mobile website Some advanced options analytics are not available on mobile. In second place is Fidelity.

Comments

Post a Comment